Car insurance quote Allstate: Ready to save big on your car insurance? Dive into the world of Allstate quotes to uncover the best deals and coverage options that suit your needs!

From understanding how quotes are calculated to exploring coverage options and comparing costs, this guide has got you covered. Let’s get started!

Understanding Car Insurance Quotes

When looking for car insurance, it’s important to understand what car insurance quotes are and how they are calculated. Car insurance quotes are estimates of how much you will pay for your car insurance coverage based on various factors. These factors can vary depending on the insurance provider and your individual circumstances.

Are you looking for a car insurance quote? Look no further! Check out Car insurance quote Progressive for a hassle-free experience. Get the best rates and coverage tailored to your needs. Don’t wait, protect your vehicle today!

Factors Influencing Car Insurance Quotes

- Your driving record: A clean driving record typically results in lower insurance quotes.

- Type of coverage: The amount and type of coverage you choose will impact the cost of your insurance.

- Age and gender: Younger drivers and males tend to pay higher premiums due to statistical risk factors.

- Location: Where you live can affect your car insurance rates due to factors like crime rates and traffic congestion.

- Type of vehicle: The make and model of your car, as well as its age and safety features, can influence your insurance quotes.

Comparison of Car Insurance Quote Calculations

- Allstate: Allstate considers factors such as your driving history, vehicle information, and coverage needs to calculate your car insurance quote.

- Geico: Geico uses similar factors but may place more emphasis on credit score and previous insurance coverage.

- Progressive: Progressive offers a Name Your Price® tool that allows you to customize coverage options to see how they impact your quote.

- State Farm: State Farm takes into account factors like your age, driving habits, and vehicle type to determine your insurance quote.

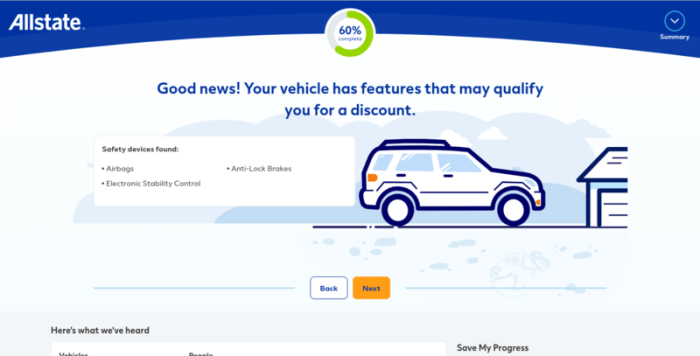

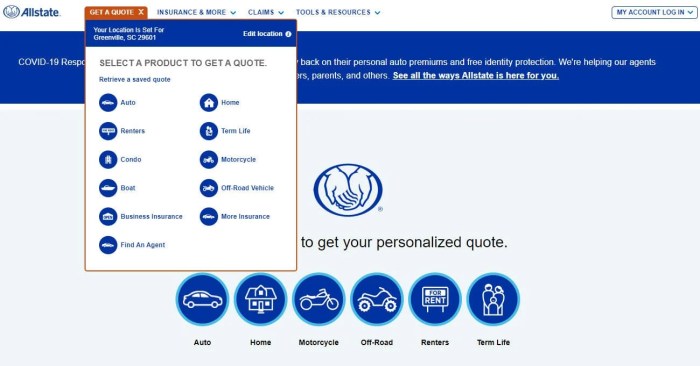

Allstate Car Insurance Quote Process: Car Insurance Quote Allstate

When obtaining a car insurance quote from Allstate, the process is straightforward and can be done online or by contacting an agent. Here’s how it works:

Information Required for Allstate Car Insurance Quote

To get a car insurance quote from Allstate, you will typically need to provide the following information:

- Your personal details, including name, address, and contact information.

- Information about your vehicle, such as make, model, year, and VIN number.

- Your driving history, including any accidents or violations.

- Details about your current insurance coverage, if applicable.

- Additional drivers who will be included on the policy.

Special Features and Discounts in Allstate Quotes, Car insurance quote Allstate

Allstate offers various special features and discounts in their car insurance quotes to help customers save money and customize their coverage. Some of these may include:

- Safe driving discounts for maintaining a good driving record.

- Multi-policy discounts for bundling car insurance with other types of insurance.

- Anti-theft device discounts for vehicles with security features installed.

- New car discounts for insuring a recently purchased vehicle.

- Accident forgiveness programs that prevent rates from increasing after a first accident.

Coverage Options in Allstate Car Insurance Quotes

When getting a car insurance quote from Allstate, it’s important to understand the different coverage options available. Each option offers specific benefits and limitations depending on your needs and circumstances.

Liability Coverage

- Liability coverage helps pay for injuries and property damage that you’re legally responsible for in an accident.

- It’s mandatory in most states and provides protection if you’re at fault in a collision.

- For example, if you rear-end another vehicle and cause damage, liability coverage will help cover the costs of the other driver’s repairs.

Collision Coverage

- Collision coverage helps pay for repairs to your vehicle after a collision with another vehicle or object.

- It’s optional but can be beneficial if you have a newer car or a car with a loan or lease.

- For instance, if you crash into a tree and damage your car, collision coverage will assist in covering the repair costs.

Comprehensive Coverage

- Comprehensive coverage helps pay for damage to your vehicle from non-collision events like theft, vandalism, or natural disasters.

- It’s also optional and provides added protection for your car.

- For example, if your car is stolen or damaged in a hailstorm, comprehensive coverage will help cover the losses.

Uninsured/Underinsured Motorist Coverage

- This coverage helps protect you if you’re in an accident with a driver who doesn’t have insurance or enough insurance to cover your damages.

- It can also help with medical expenses if you’re injured in a hit-and-run accident.

- For instance, if you’re hit by an uninsured driver and sustain injuries, uninsured motorist coverage will step in to cover your medical bills.

Cost Comparison

When looking for car insurance, comparing costs between different providers is essential to ensure you are getting the best coverage at the most competitive price. In this section, we will compare the cost of car insurance quotes between Allstate and other providers, highlighting key differences in coverage, pricing, and customer satisfaction.

Are you looking for a car insurance quote from Progressive? Look no further! Get a personalized quote today with Car insurance quote Progressive and make sure you’re getting the best deal out there. Don’t wait, protect your car and your wallet now!

Allstate vs. Competitors

- Allstate offers competitive rates for car insurance coverage, with a variety of discounts available for policyholders.

- Other providers may offer lower premiums initially, but the coverage and customer service may not be as comprehensive as Allstate.

- Customer reviews often highlight Allstate’s competitive pricing and excellent customer service compared to other providers.

Conclusion

Ready to secure the perfect car insurance plan? With Allstate’s quotes, you can find the ideal balance between cost and coverage. Drive with peace of mind knowing you’re protected on the road!

Top FAQs

What factors influence car insurance quotes?

Factors like age, driving record, location, and type of vehicle can impact your car insurance quotes.

What special features does Allstate offer in their quotes?

Allstate provides features like accident forgiveness and safe driving bonuses in their quotes.

How do coverage options differ in Allstate car insurance quotes?

Allstate offers various coverage options including liability, comprehensive, and collision coverage with different benefits and limits.

Is there a cost comparison available between Allstate and other providers?

Yes, a cost comparison table is provided to show the differences in pricing and coverage between Allstate and competitors.