Progressive car insurance quote high-risk drivers takes center stage, offering a glimpse into the world of insurance for risky drivers. Buckle up as we explore how to get the best rates possible!

Understanding Progressive Car Insurance for High-Risk Drivers

When it comes to car insurance, high-risk drivers are individuals who are more likely to file a claim due to their driving history, habits, or other factors that make them riskier to insure. Progressive, like many other insurance companies, categorizes drivers based on certain criteria to determine their risk level and set appropriate premiums.

Factors that Classify a Driver as High-Risk

- Multiple Traffic Violations: Drivers with a history of speeding tickets, reckless driving, DUIs, or other serious infractions are often considered high-risk.

- Accident History: Being involved in multiple accidents, especially those deemed at-fault, can raise a driver’s risk profile.

- Lack of Experience: New or inexperienced drivers, such as teenagers or those with limited driving history, may be classified as high-risk.

- Poor Credit Score: Insurance companies often correlate a low credit score with a higher likelihood of filing claims, leading to higher premiums.

Examples of Behaviors or Circumstances

- Driving Under the Influence: Being arrested for DUI or DWI can result in being labeled as high-risk by insurance companies.

- Multiple At-Fault Accidents: If a driver has a history of causing accidents, they are likely to be considered high-risk.

- SR-22 Requirement: Requiring an SR-22 form due to serious driving violations indicates a high-risk driver status.

Progressive’s Approach to High-Risk Drivers

Progressive uses a variety of factors to assess high-risk drivers when providing insurance quotes. These factors help determine the rates they offer to these individuals.

Looking for a cheap auto insurance quote? Look no further than Cheap auto insurance quote Progressive ! Progressive offers competitive rates and excellent coverage options to fit your needs. Don’t break the bank, get a quote today and see how much you can save!

Criteria for Determining Rates

- Driving Record: Progressive considers the driver’s history of accidents, violations, and claims to assess the level of risk.

- Age and Experience: Young and inexperienced drivers are often considered high-risk due to their lack of driving history.

- Vehicle Type: The make and model of the vehicle can also impact the rates for high-risk drivers.

- Location: The area where the driver lives and drives can affect the risk level assigned by Progressive.

- Credit History: Progressive may also consider the driver’s credit score as a factor in determining rates.

Special Programs for High-Risk Drivers

- Snapshot Program: Progressive offers a usage-based insurance program where drivers can save money based on their driving habits.

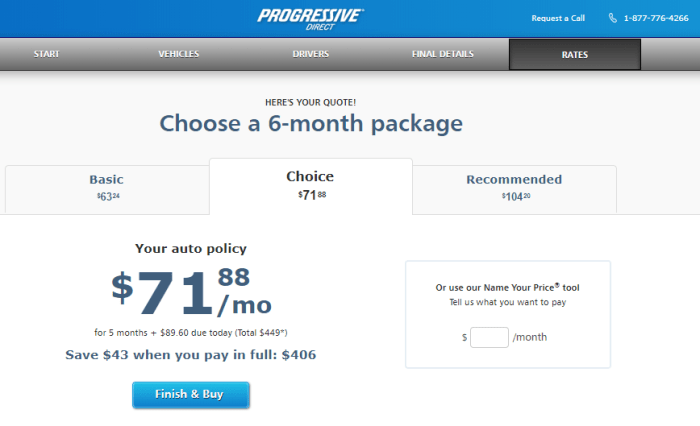

- Name Your Price Tool: This tool allows high-risk drivers to customize their coverage options based on their budget.

- Deductible Savings Bank: Progressive offers a program that rewards safe driving with deductible savings for high-risk drivers.

Factors Influencing Progressive Car Insurance Quotes for High-Risk Drivers: Progressive Car Insurance Quote High-risk Drivers

When it comes to determining car insurance quotes for high-risk drivers, several key factors come into play. These factors can significantly impact the cost of insurance compared to low-risk drivers. Let’s explore some of the main variables that influence Progressive car insurance quotes for high-risk drivers.

Driving Record, Progressive car insurance quote high-risk drivers

- High-risk drivers typically have a history of traffic violations, accidents, or DUI convictions, which can lead to higher insurance premiums.

- Progressive considers the number and severity of incidents on a driver’s record when calculating quotes.

- A clean driving record is crucial for obtaining lower insurance rates.

Age and Experience

- Youthful drivers or those with limited driving experience are often considered high-risk by insurance companies.

- Progressive may charge higher premiums for younger drivers due to their increased likelihood of accidents.

- Older drivers with a long history of safe driving may qualify for lower rates despite being high-risk.

Type of Vehicle

- The make and model of the vehicle being insured can affect insurance costs for high-risk drivers.

- Expensive or high-performance vehicles may lead to higher premiums due to increased repair costs.

- Progressive takes into account the safety ratings of vehicles and their likelihood of being stolen when calculating quotes.

Tips for High-Risk Drivers Seeking Progressive Car Insurance Quotes

As a high-risk driver looking for car insurance quotes from Progressive, there are several strategies you can implement to potentially lower your rates and improve your driving record. By following these tips, you can navigate the process more effectively and increase your chances of securing a competitive insurance quote.

Strategies to Improve Driving Record and Insurance Rates

- Attend defensive driving courses: Completing a defensive driving course can demonstrate to insurers that you are committed to improving your driving skills, potentially leading to lower insurance rates.

- Drive safely and avoid traffic violations: By obeying traffic laws, avoiding accidents, and maintaining a clean driving record, you can show insurers that you are a responsible driver, which may result in better insurance quotes.

- Consider installing a telematics device: Progressive offers the Snapshot program, which monitors your driving habits and can lead to discounts based on safe driving behavior.

Ways to Navigate the Process of Obtaining a Car Insurance Quote

Be honest about your driving history and provide accurate information when requesting a quote from Progressive. This will help you receive a more precise estimate of your insurance costs.

Are you looking for a cheap auto insurance quote? Look no further than Progressive! With Progressive, you can get a cheap auto insurance quote Progressive that fits your budget and provides the coverage you need. Don’t wait, get your quote today and start saving!

- Compare quotes from multiple insurers: Shopping around and obtaining quotes from different insurance companies can help you find the best rates available for your high-risk profile.

- Work with an independent insurance agent: An insurance agent can help you understand your options, navigate the quoting process, and potentially find discounts that apply to your situation.

- Ask about available discounts: Progressive offers various discounts for factors such as bundling policies, maintaining a good credit score, and being a safe driver. Inquiring about these discounts can help you lower your insurance costs.

Epilogue

As we wrap up our discussion on Progressive car insurance quote high-risk drivers, remember to drive safely and explore all options to secure the best insurance rates for your needs.

User Queries

What defines high-risk drivers?

High-risk drivers are those with a history of accidents, traffic violations, or poor credit scores that indicate a higher likelihood of filing claims.

How can high-risk drivers lower their insurance quotes with Progressive?

High-risk drivers can potentially lower their quotes by taking defensive driving courses, improving their credit score, or opting for a higher deductible.

Does Progressive offer any special programs for high-risk drivers?

Yes, Progressive may offer programs like Snapshot which tracks your driving habits to potentially lower rates for safe driving.