Auto insurance quote Allstate takes center stage in this comprehensive guide, offering a glimpse into the world of insurance quotes with Allstate. Get ready for a ride filled with valuable insights and tips to help you make informed decisions.

Whether you’re a seasoned insurance shopper or new to the game, this guide has something for everyone looking to navigate the world of auto insurance quotes with Allstate.

Overview of Allstate Auto Insurance Quote

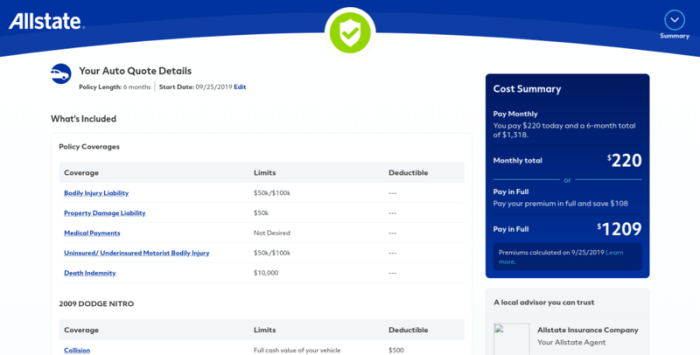

When you request an auto insurance quote from Allstate, you will receive a personalized estimate of how much you can expect to pay for coverage based on your specific needs and circumstances. Allstate takes into account various factors to calculate your auto insurance quote, ensuring that it is tailored to your individual situation.

What an Allstate Auto Insurance Quote Includes

- Your selected coverage options, such as liability, collision, comprehensive, and more.

- Details about your vehicle, including make, model, year, and mileage.

- Information about the drivers to be insured, such as their driving history and age.

- Any applicable discounts or savings opportunities.

How Allstate Calculates Auto Insurance Quotes

Allstate uses a variety of factors to determine your auto insurance quote, including:

- Your driving record, including any accidents or traffic violations.

- The type of vehicle you drive, as well as its age and condition.

- Your location, as certain areas may have higher rates of accidents or theft.

- Your age, gender, and marital status, which can impact your risk profile.

Factors that Influence Allstate’s Auto Insurance Quotes

- Driving history: A clean driving record may result in lower premiums.

- Vehicle type: More expensive or high-performance vehicles may cost more to insure.

- Location: Living in a densely populated area or high-crime neighborhood can increase rates.

- Coverage options: Choosing higher coverage limits or additional protections can raise premiums.

Allstate Auto Insurance Coverage Options

When it comes to auto insurance, Allstate offers a variety of coverage options to meet the needs of different drivers. Each coverage option provides specific benefits and protection in various situations. Let’s take a closer look at the different types of coverage options available with Allstate.

Hey there, world! Ready to explore new horizons? Check out this awesome article on Hello world! and dive into the endless possibilities that await you. Let’s embark on this exciting journey together!

Liability Coverage

Liability coverage helps cover costs associated with injuries or property damage you are responsible for in an accident. This includes legal fees, medical expenses, and property repairs for the other party involved.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if you are involved in a collision with another vehicle or object. This coverage is particularly beneficial if you have a new or valuable car that you want to protect.

Comprehensive Coverage

Comprehensive coverage helps cover damage to your vehicle that is not the result of a collision, such as theft, vandalism, or natural disasters. This coverage provides additional peace of mind and financial protection.

Hey there, ready to say “Hello world!” to the insurance world? Well, look no further than Hello world! This is where you can kickstart your journey into the realm of insurance with all the tips and tricks you need to know.

So go ahead, click on the link and let’s dive in together!

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage helps cover medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. This coverage can be particularly beneficial if you do not have health insurance.

Uninsured/Underinsured Motorist Coverage, Auto insurance quote Allstate

Uninsured/Underinsured Motorist Coverage helps protect you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your expenses. This coverage can help ensure you are not left with unexpected costs.

Rental Reimbursement Coverage

Rental Reimbursement Coverage helps cover the cost of a rental car if your vehicle is in the shop for repairs after an accident. This coverage can be especially useful if you rely on your vehicle for daily transportation.

Obtaining an Auto Insurance Quote from Allstate

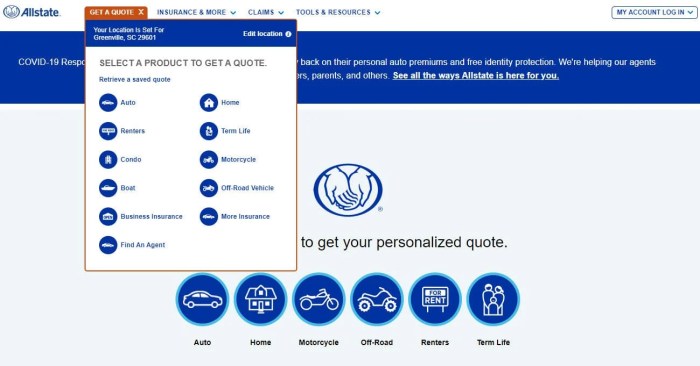

To get an auto insurance quote from Allstate, you can either visit their website or contact an Allstate agent directly. The process is simple and can be completed in just a few steps.

Information Required for an Accurate Quote

When obtaining an auto insurance quote from Allstate, you will need to provide some basic information about yourself and your vehicle. This may include your name, address, date of birth, driver’s license number, vehicle make and model, and driving history.

The more accurate and detailed information you provide, the more accurate your quote will be.

Allstate Online Tools and Resources

Allstate offers a variety of online tools and resources to help you get an accurate auto insurance quote. Their website features a user-friendly interface where you can input your information and receive a quote instantly. You can also use their online quote tool to compare different coverage options and prices to find the best policy for your needs.

- Allstate’s online quote tool allows you to customize your coverage options and deductibles to see how they affect your premium.

- You can also access resources on the Allstate website to learn more about auto insurance coverage, discounts, and ways to save money on your policy.

- If you have any questions or need assistance while obtaining a quote, you can easily reach out to an Allstate agent through their website or by phone.

Comparing Allstate Auto Insurance Quotes

When looking to compare Allstate auto insurance quotes with quotes from other insurance providers, it’s essential to consider various factors to ensure you’re getting the best coverage at the most competitive rate. Allstate offers unique features and advantages that can make a difference in your decision-making process.

Here are some tips on how to effectively compare quotes and make an informed decision:

Unique Features and Advantages of Allstate Auto Insurance Quotes

Allstate provides a wide range of coverage options and discounts that cater to individual needs. Some unique features include:

- Accident Forgiveness: Allstate offers accident forgiveness, which means your rates won’t go up just because of an accident, even if it’s your fault.

- New Car Replacement: If your new car is totaled within the first three model years, Allstate will replace it with a new car of the same make and model.

- Safe Driving Bonus: With the Allstate Safe Driving Bonus, you can earn a bonus every six months you drive accident-free.

Tips for Effective Comparison

When comparing auto insurance quotes, consider the following tips:

- Compare Coverage Options: Make sure you’re comparing the same coverage types and limits across different quotes to get an accurate comparison.

- Check Discounts: Look for any discounts or savings opportunities offered by each provider to see where you can save the most.

- Review Customer Satisfaction: Check customer reviews and ratings to get an idea of the overall customer experience with each insurance provider.

- Consider Customer Service: Evaluate the ease of claims processing and customer service quality to ensure a smooth experience in case you need to file a claim.

Closing Notes

In conclusion, Auto insurance quote Allstate opens up a world of possibilities for those seeking reliable coverage. With a wealth of options and resources at your fingertips, finding the right auto insurance quote has never been easier. Stay informed, stay covered, and drive with peace of mind.

FAQ Section: Auto Insurance Quote Allstate

What does an auto insurance quote from Allstate include?

An auto insurance quote from Allstate typically includes coverage options for your vehicle, liability protection, and any additional features you may choose.

How does Allstate calculate auto insurance quotes?

Allstate calculates auto insurance quotes based on factors such as your driving record, the type of vehicle you drive, your location, and coverage options selected.

What information is required to get an accurate quote from Allstate?

To get an accurate quote from Allstate, you’ll need to provide details about your driving history, the vehicles you want to insure, and the coverage options you’re interested in.

How can I compare Allstate’s auto insurance quotes with other providers?

You can compare Allstate’s auto insurance quotes with other providers by requesting quotes from multiple companies and evaluating the coverage options, prices, and customer reviews.