Looking to save on auto insurance? Look no further than State Farm for a quote that fits your budget and needs. With Auto insurance quote State Farm at the helm, get ready to dive into the world of affordable coverage options and great benefits.

Introduction to State Farm Auto Insurance

State Farm is a well-known insurance company that has been in the industry for decades, offering a wide range of insurance products to meet the needs of their customers. When it comes to auto insurance, State Farm is known for its reliable coverage options, excellent customer service, and competitive rates.

Hey there, parents! Are you worried about finding the best car insurance quote for your teenager? Look no further! Check out this amazing offer from State Farm for car insurance specifically tailored for teenagers. Get your quote today and ensure your teen hits the road safely and securely.

Click here for more details: State Farm car insurance quote for teenagers.

Types of Auto Insurance Coverage

- Liability Coverage: This coverage helps pay for damages and injuries you cause to others in an accident.

- Collision Coverage: Covers damage to your vehicle in the event of a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers you if you’re in an accident with a driver who doesn’t have insurance or enough coverage.

- Medical Payments Coverage: Helps pay for medical expenses for you and your passengers after an accident, regardless of fault.

Benefits of Getting an Auto Insurance Quote from State Farm

- Personalized Coverage Options: State Farm offers customizable coverage options to fit your specific needs and budget.

- 24/7 Customer Support: You can reach State Farm anytime, day or night, for assistance with claims, questions, or policy changes.

- Discounts and Savings: State Farm provides various discounts for safe driving, bundling policies, and more, helping you save on your premiums.

- Mobile App Access: Manage your policy, file claims, and access important documents easily through the State Farm mobile app.

- Strong Financial Stability: State Farm has a solid financial standing, ensuring they can fulfill their obligations to policyholders when needed.

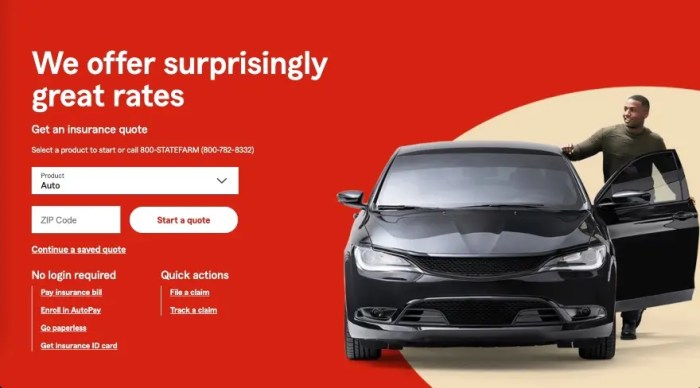

Getting an Auto Insurance Quote from State Farm

When you’re looking to get an auto insurance quote from State Farm, the process is relatively straightforward. You can either visit their website or call their customer service hotline to get started. You will need to provide some basic information about yourself and your vehicle in order to receive a quote.Factors that may impact the quote you receive include your driving record, the type of coverage you’re looking for, the make and model of your vehicle, your age, and where you live.

State Farm will take all of these factors into consideration when calculating your quote.

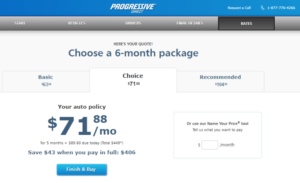

Comparing the Quote Process with Other Insurance Providers

When comparing the quote process with other insurance providers, State Farm is known for its personalized approach. They take the time to understand your individual needs and tailor a quote that fits your specific situation. Other providers may offer quick quotes online, but they may not take into account all of the factors that State Farm considers.State Farm also has a strong reputation for customer service, so you can expect a high level of support throughout the quote process and beyond.

While other providers may offer lower initial quotes, the level of service and coverage may not be as comprehensive as what State Farm can provide.

Factors Affecting Auto Insurance Quotes

When seeking an auto insurance quote, several key factors come into play that can significantly influence the cost you are quoted. Understanding these factors can help you make informed decisions when selecting the right coverage for your needs.

Personal Information and Driving History

- Your age, gender, marital status, and credit score can all impact your auto insurance quote. Younger drivers and males tend to pay higher premiums due to a higher risk of accidents. Additionally, a poor credit score may also result in a higher insurance rate.

- Your driving history, including any past accidents, traffic violations, or claims, can also affect your insurance premium. A clean driving record typically leads to lower rates, while a history of accidents or tickets may result in higher costs.

Vehicle Type

- The make and model of your vehicle, as well as its age and safety features, can influence your insurance quote. Newer cars with advanced safety features may qualify for discounts, while high-performance vehicles or luxury cars may come with higher premiums.

- The cost of repairs, theft rates, and overall safety ratings of your vehicle can also impact your insurance rate. Insuring a car that is expensive to repair or more likely to be stolen can lead to higher premiums.

Location and Coverage Options

- Where you live plays a significant role in determining your auto insurance premium. Urban areas with higher traffic congestion and crime rates often have higher insurance costs compared to rural areas.

- The coverage options you choose, such as liability, collision, comprehensive, and deductibles, will also affect your insurance quote. Opting for higher coverage limits or lower deductibles can result in a higher premium.

Understanding Coverage Options

When it comes to auto insurance, understanding the coverage options available is crucial to ensure you have the protection you need in case of an accident or other unforeseen events.

Liability Coverage

Liability coverage is required in most states and helps pay for injuries and property damage you cause to others in a car accident. This coverage is divided into bodily injury liability and property damage liability. For example, if you cause an accident and injure someone, liability coverage can help cover their medical expenses.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if you’re in an accident with another vehicle or object, regardless of fault. For instance, if you collide with another car or hit a tree, collision coverage can help cover the cost of repairing or replacing your vehicle.

Hey there, are you a teenager looking for a car insurance quote? Look no further! Check out State Farm for a great deal on car insurance tailored for teenagers. Get your personalized quote today by visiting State Farm car insurance quote for teenagers.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters. If your car is stolen or damaged in a hailstorm, comprehensive coverage can help cover the repairs or replacement.

Comparing State Farm Auto Insurance Quotes

When it comes to auto insurance, comparing quotes from different providers, including State Farm, is crucial to finding the best coverage at the right price. By comparing quotes, you can ensure you are getting the most value for your money and the coverage that meets your needs.

Importance of Comparing Coverage Limits and Deductibles, Auto insurance quote State Farm

- When comparing auto insurance quotes, it is essential to look at the coverage limits offered by each provider. Coverage limits determine the maximum amount an insurer will pay for a covered claim. Make sure the coverage limits are adequate to protect you in case of an accident or other unforeseen events.

- Another important factor to consider is the deductible amount. The deductible is the amount you have to pay out of pocket before your insurance kicks in. Higher deductibles typically result in lower premiums, but you need to ensure you can afford the deductible amount if you need to file a claim.

- Comparing coverage limits and deductibles from different insurance providers will help you understand the value and level of protection each policy offers.

Tips on Effectively Comparing Quotes

- Get quotes from multiple insurers, not just State Farm, to compare rates and coverage options.

- Make sure you are comparing similar coverage levels and deductibles to get an accurate comparison.

- Consider additional coverage options, such as roadside assistance or rental car reimbursement, when comparing quotes.

- Look for discounts or savings opportunities that may be available with each insurer.

- Read the policy details carefully to understand exclusions, limitations, and any additional fees that may apply.

Ultimate Conclusion: Auto Insurance Quote State Farm

In conclusion, State Farm’s auto insurance quotes offer a mix of value and reliability that can’t be beaten. Don’t miss out on the chance to secure your vehicle with a trusted provider like State Farm.

Top FAQs

What sets State Farm apart in the insurance industry?

State Farm is known for its excellent customer service, wide range of coverage options, and competitive pricing.

How can I compare State Farm’s auto insurance quote with other providers?

You can compare quotes by looking at coverage limits, deductibles, and any additional benefits offered by each provider.

What factors influence the cost of auto insurance quotes?

Factors like driving history, location, vehicle type, and coverage options can impact the cost of your auto insurance quote.