Car insurance quote comparison State Farm takes center stage, inviting you on a journey filled with valuable insights and tips. Get ready to explore the world of insurance comparisons with State Farm in a whole new light!

When it comes to finding the right car insurance, State Farm stands out as a reliable option with unique offerings that set it apart from the competition. Let’s delve into the details and uncover how you can benefit from their services.

Introduction to Car Insurance Quote Comparison with State Farm

When it comes to car insurance, it’s essential to compare quotes to ensure you’re getting the best coverage at the most competitive rates. State Farm, a well-known insurance provider, offers a range of options that set it apart in the industry.

Why Compare Car Insurance Quotes?

Comparing car insurance quotes allows you to find the most cost-effective coverage that meets your needs. By exploring different options, you can save money while still getting the protection you require.

Are you looking for an instant auto insurance quote? Look no further than GEICO! With GEICO, you can get a quick and easy quote online in just minutes. Don’t waste time waiting on the phone or filling out endless forms.

Click here to get your Instant auto insurance quote GEICO now and see how much you could save!

State Farm’s Standout Features

- State Farm is known for its excellent customer service, with agents ready to assist you with any questions or claims.

- They offer a variety of discounts, such as safe driver discounts and multi-policy discounts, to help you save on your premiums.

- State Farm provides a user-friendly online platform where you can easily manage your policy, make payments, and file claims.

Benefits of Using State Farm for Car Insurance

- State Farm’s extensive network of agents ensures personalized attention and support throughout the insurance process.

- With a range of coverage options, including liability, collision, and comprehensive, State Farm allows you to tailor your policy to fit your needs.

- State Farm’s long-standing reputation for reliability and financial stability gives you peace of mind knowing your claims will be handled efficiently.

Factors to Consider When Comparing Car Insurance Quotes

When comparing car insurance quotes, there are several key factors to keep in mind that can impact the coverage options, deductibles, premiums, and overall value of the policy. Factors such as driving history, location, discounts, and additional services play a crucial role in the comparison process.

Coverage Options

- Consider the types of coverage offered by each insurance provider, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Evaluate the limits and exclusions of each coverage option to ensure it meets your needs and provides adequate protection.

Deductibles

- Compare the deductibles for each coverage type, as a higher deductible typically results in lower premiums but may require more out-of-pocket expenses in the event of a claim.

- Understand how deductibles impact your overall insurance costs and financial risk, and choose a deductible that aligns with your budget and risk tolerance.

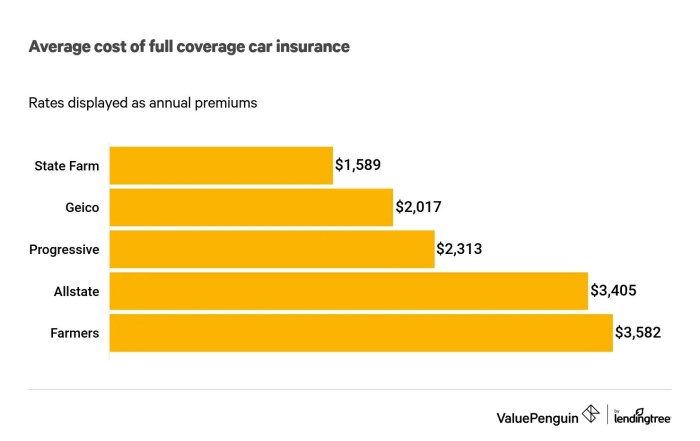

Premiums

- Obtain quotes from multiple insurance companies to compare premiums for the same coverage options and deductibles, ensuring you are getting the best value for your money.

- Consider any discounts or incentives offered by each insurer that could lower your premium, such as bundling policies, safe driving discounts, or loyalty rewards.

Driving History and Location

- Your driving record, including any past accidents, traffic violations, or claims, can impact your insurance quotes, with a clean record typically resulting in lower premiums.

- The location where you live and park your car also plays a role, as urban areas with higher crime rates or traffic congestion may lead to higher insurance rates.

Discounts and Additional Services

- Take advantage of discounts offered by insurance companies, such as multi-policy discounts, good student discounts, or telematics programs that monitor your driving behavior.

- Consider any additional services provided by insurers, such as roadside assistance, rental car coverage, or accident forgiveness, which can add value to your policy.

How to Compare Car Insurance Quotes with State Farm

When comparing car insurance quotes with State Farm, it’s essential to follow a few simple steps to ensure you get the best coverage at the right price. State Farm offers online tools that make the process easy and convenient for customers.

Here is a breakdown of how to compare car insurance quotes with State Farm:

Obtaining Quotes from State Farm, Car insurance quote comparison State Farm

- Visit the State Farm website or contact a local agent to get started.

- Provide the necessary information such as your vehicle details, driving history, and coverage preferences.

- Receive quotes from State Farm based on the information provided.

Online Tools for Comparing Quotes

- State Farm’s online quote tool allows you to compare different coverage options and prices easily.

- You can customize your coverage preferences and see how they affect the overall cost of the policy.

- Use the online tools to adjust deductibles, limits, and add-ons to find the best policy for your needs.

Customizing Coverage Options with State Farm

- State Farm offers a range of coverage options to choose from, including liability, collision, comprehensive, and more.

- Work with a State Farm agent to customize your policy to fit your specific needs and budget.

- Consider factors such as your driving habits, the value of your vehicle, and your financial situation when customizing your coverage options.

Understanding Coverage Options with State Farm

When it comes to car insurance, understanding the coverage options offered by State Farm is essential to make an informed decision. State Farm provides a range of coverage types to protect you and your vehicle in various situations.

Types of Coverage Offered by State Farm

- Liability Coverage: This type of coverage helps pay for injuries and property damage you cause to others in a car accident.

- Comprehensive Coverage: Comprehensive coverage helps pay for damage to your car caused by events other than a collision, such as theft, vandalism, or natural disasters.

- Collision Coverage: Collision coverage helps pay for damage to your car resulting from a collision with another vehicle or object.

- Personal Injury Protection (PIP): PIP coverage helps cover medical expenses for you and your passengers after an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or enough insurance to cover your expenses.

Comparing State Farm’s Coverage Options

When comparing State Farm’s coverage options with other insurance providers, it’s important to consider the level of coverage offered, deductibles, and premiums. State Farm is known for its reliable customer service and comprehensive coverage options, making it a popular choice for many drivers.

Scenarios where Each Type of Coverage is Beneficial

- Liability Coverage:In a scenario where you are at fault for causing an accident that results in injuries to others or damage to their property, liability coverage will help cover the costs of medical bills and repairs.

- Comprehensive Coverage:If your car is damaged in a hailstorm or stolen, comprehensive coverage will help cover the costs of repairs or replacement, providing peace of mind in unpredictable situations.

- Collision Coverage:Collision coverage is beneficial in scenarios where you collide with another vehicle or object, covering the costs of repairing your car regardless of fault.

- Personal Injury Protection (PIP):PIP coverage is essential in scenarios where you or your passengers are injured in an accident, helping cover medical expenses and lost wages.

- Uninsured/Underinsured Motorist Coverage:If you’re involved in an accident with an uninsured or underinsured driver, this coverage will help protect you from paying out-of-pocket for damages and medical expenses.

Tips for Saving Money on Car Insurance with State Farm: Car Insurance Quote Comparison State Farm

When it comes to saving money on car insurance with State Farm, there are several strategies you can implement to lower your premiums and get the best possible rates. From bundling options to maintaining a good driving record, here are some tips to help you save on your car insurance.

Bundling Options for Additional Savings

- Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to take advantage of multi-policy discounts.

- By combining different insurance policies with State Farm, you can often enjoy significant savings on your overall insurance costs.

Maintaining a Good Driving Record for Lower Rates

- One of the most effective ways to save money on car insurance with State Farm is by maintaining a clean driving record.

- Safe driving habits and avoiding accidents or traffic violations can lead to lower rates and discounts on your car insurance premiums.

- State Farm rewards good drivers with lower rates, so it’s important to drive safely and responsibly to qualify for these savings.

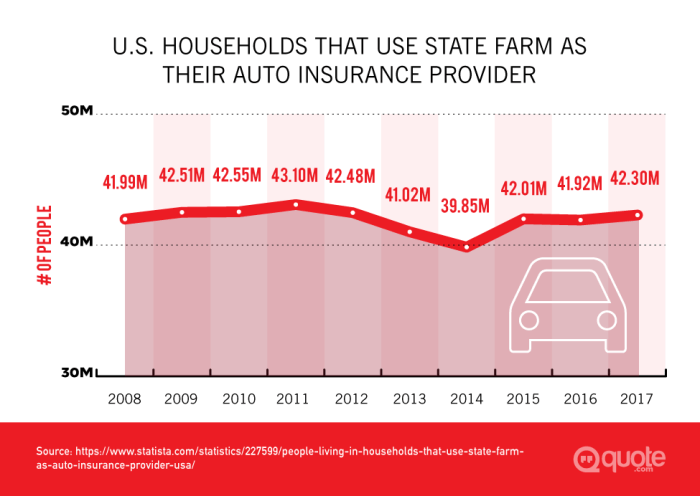

Customer Reviews and Satisfaction with State Farm

When it comes to evaluating car insurance providers, customer reviews play a crucial role in determining the level of satisfaction and service quality. State Farm, as one of the leading insurance companies in the market, has garnered a substantial amount of feedback from its customers regarding their car insurance services.

Are you looking for an instant auto insurance quote? Look no further than GEICO! With GEICO, you can easily get a quick and accurate quote online in just a few minutes. Click here to get your Instant auto insurance quote GEICO now and see how much you could save!

Summary of Customer Feedback

- State Farm has received positive reviews for their responsive customer service and claims processing.

- Customers appreciate the ease of filing claims and the efficiency in resolving issues.

- Many policyholders have praised State Farm for their competitive rates and discounts offered.

- Some customers have highlighted the personalized approach of State Farm agents in assisting with policy customization.

Analysis of Reviews

- Common Themes: The reviews often mention the quick response times of State Farm representatives, the affordability of their policies, and the overall reliability of their services.

- Satisfaction Levels: The majority of customers seem satisfied with State Farm’s car insurance offerings, citing a sense of security and peace of mind with their coverage.

Impact on Decision-making

- Customer reviews can significantly influence the decision-making process for individuals seeking car insurance. Positive feedback can instill confidence in a prospective customer, while negative reviews may deter them from choosing a particular insurer.

- By analyzing customer reviews, potential policyholders can gain insights into the strengths and weaknesses of State Farm’s car insurance services, helping them make an informed choice based on real experiences shared by others.

Final Conclusion

In conclusion, Car insurance quote comparison State Farm opens up a world of possibilities for savvy insurance shoppers. With the right knowledge and tools, you can make informed decisions to protect your vehicle and save money along the way. Dive into the world of insurance comparisons with State Farm and unlock a wealth of benefits today!

Key Questions Answered

What factors should I consider when comparing car insurance quotes?

When comparing car insurance quotes, it’s essential to look at coverage options, deductibles, premiums, driving history, and location impact.

How can I save money on car insurance with State Farm?

You can save money on car insurance with State Farm by exploring strategies to lower premiums, taking advantage of bundling options, and maintaining a good driving record.

What types of coverage does State Farm offer?

State Farm offers various types of coverage such as liability, comprehensive, collision, and more. Each type serves different purposes depending on your needs.