Car insurance quote State Farm sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with entertaining interactive style and brimming with originality from the outset.

Are you ready to dive into the world of car insurance quotes with State Farm? Buckle up as we explore everything you need to know about getting the best deal on your coverage!

Introduction to State Farm Car Insurance Quote

When you’re in the market for car insurance, one of the first steps is to obtain a car insurance quote. A car insurance quote is an estimate of how much you can expect to pay for coverage based on factors such as your driving record, the type of car you drive, and your location.

Obtaining a car insurance quote from State Farm is significant because State Farm is a reputable insurance provider known for its excellent customer service, competitive rates, and wide range of coverage options. By getting a quote from State Farm, you can make an informed decision about your car insurance needs.

Benefits of Getting a Car Insurance Quote from State Farm, Car insurance quote State Farm

- Personalized Coverage Options: State Farm offers a variety of coverage options that can be tailored to your specific needs, ensuring you have the right amount of protection.

- Competitive Rates: State Farm is known for offering competitive rates that can help you save money on your car insurance premiums.

- Excellent Customer Service: State Farm has a reputation for providing exceptional customer service, so you can trust that you’ll be taken care of in the event of a claim.

- Convenience: With State Farm, you can easily obtain a car insurance quote online or through a local agent, making the process quick and hassle-free.

Coverage Options Offered by State Farm

When it comes to car insurance, State Farm offers a variety of coverage options to meet the needs of different drivers. Understanding these options is essential to ensure you have the right level of protection in case of an accident or other unforeseen events.

Are you a new driver looking for an affordable auto insurance quote? Look no further than State Farm auto insurance quote for new drivers. With State Farm, you can get a personalized quote that fits your needs and budget.

Don’t break the bank just to get on the road – check out State Farm today!

Liability Coverage

- Provides financial protection for you if you are found legally responsible for causing an accident.

- Includes bodily injury liability to cover medical expenses and lost wages, and property damage liability for repairs or replacement of damaged property.

Collision Coverage

- Pays for repairs to your vehicle after a collision with another vehicle or object, regardless of fault.

- Helps cover the cost of damages to your car, minus your deductible.

Comprehensive Coverage

- Protects your vehicle from non-collision incidents such as theft, vandalism, natural disasters, and falling objects.

- Covers the cost of repairs or replacement of your car, minus your deductible.

Medical Payments Coverage

- Helps pay for medical expenses for you and your passengers after an accident, regardless of fault.

- Can also cover funeral expenses in the event of a fatal accident.

Uninsured/Underinsured Motorist Coverage

- Provides protection if you are involved in an accident with a driver who has little to no insurance.

- Covers medical expenses, lost wages, and other damages that the at-fault driver’s insurance may not fully cover.

Rental Car Reimbursement

- Helps cover the cost of a rental car while your vehicle is being repaired after a covered claim.

- Ensures you have a temporary means of transportation without incurring additional expenses.

Factors Affecting Car Insurance Quotes

When it comes to determining car insurance quotes, several key factors come into play. These factors can significantly impact the cost of your insurance premium. Let’s take a closer look at how personal information such as age, driving history, and location can influence the price you pay for car insurance.

Age

Age is a significant factor that insurance companies consider when calculating your car insurance premium. Younger drivers, especially teenagers, are often charged higher rates due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers may also face higher premiums as they are considered to have a higher risk of accidents due to potential health issues affecting their driving abilities.

Are you a new driver looking for affordable auto insurance? Look no further than State Farm! Get a quick and easy State Farm auto insurance quote for new drivers today. Don’t break the bank, protect your car without breaking a sweat!

Driving History

Your driving history plays a crucial role in determining your car insurance rates. Insurance companies will look at factors such as your driving record, including any past accidents, traffic violations, and claims history. A clean driving record with no accidents or tickets can lead to lower premiums, while a history of accidents or violations may result in higher rates.

Location

Where you live can also impact the cost of your car insurance. Urban areas with higher rates of accidents and theft may result in higher premiums compared to rural areas with lower traffic and crime rates. Additionally, factors such as weather conditions and local traffic patterns can influence insurance rates based on the likelihood of accidents in your area.

Ways to Lower Car Insurance Premiums

There are several ways you can potentially reduce your car insurance premiums. Maintaining a clean driving record, bundling your car insurance with other policies, such as homeowners or renters insurance, opting for a higher deductible, and taking advantage of discounts offered by insurance companies can all help lower your insurance costs.

Additionally, driving a safer car with advanced safety features can also lead to potential discounts on your premium.

Obtaining a Car Insurance Quote from State Farm

When looking to get a car insurance quote from State Farm, the process is relatively straightforward. Here is a step-by-step guide on how to request a car insurance quote from State Farm.

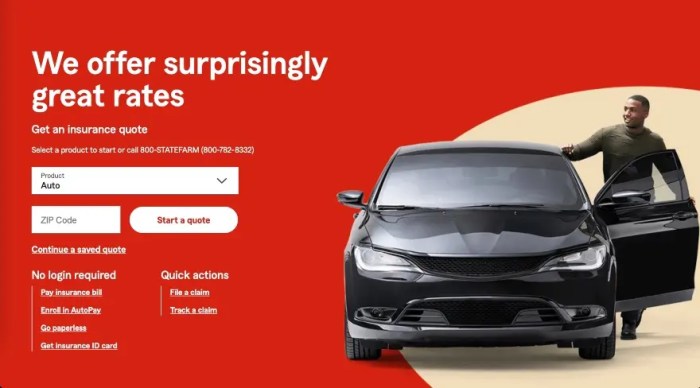

Step 1: Visit State Farm Website

To begin the process, visit the State Farm website and navigate to the car insurance section.

Step 2: Enter Personal Information

You will be asked to enter personal information such as your name, address, and contact details. This information is crucial for providing an accurate quote.

Step 3: Vehicle Information

Next, you will need to input details about your vehicle, including the make, model, year, and mileage. This information helps determine the coverage options and premiums.

Step 4: Driving History

You will also be required to provide details about your driving history, including any accidents or traffic violations. This information helps assess your risk profile.

Step 5: Coverage Preferences

Choose the coverage options you desire, such as liability, comprehensive, collision, and additional features like roadside assistance or rental car coverage.

Step 6: Review and Submit

Review all the information you provided to ensure accuracy and then submit your request for a car insurance quote.

Online vs. In-person Quoting

While obtaining a car insurance quote online is convenient and fast, some individuals prefer in-person interactions for a more personalized experience. State Farm offers both options to cater to different preferences.

Customer Reviews and Satisfaction with State Farm Car Insurance

State Farm has garnered a reputation for providing reliable car insurance services to customers across the country. Let’s take a look at what customers have to say about their experience with State Farm’s car insurance offerings.

Testimonials from Satisfied Customers

- One customer mentioned, “I’ve been a State Farm customer for years, and their car insurance coverage has always given me peace of mind on the road.”

- Another satisfied policyholder stated, “The claims process with State Farm was hassle-free and efficient. I was impressed by their prompt service.”

Overall Customer Satisfaction Ratings

- State Farm has consistently received high ratings for customer satisfaction in the car insurance industry.

- According to surveys, a significant percentage of State Farm customers express satisfaction with the company’s policies and customer service.

Common Feedback and Complaints

- Some customers have mentioned experiencing slight increases in their premiums over time, which can be a concern for budget-conscious individuals.

- Occasionally, there have been complaints about delays in claims processing, although State Farm continues to work on improving their efficiency in this area.

Closing Notes

As we conclude our journey through the realm of car insurance quotes with State Farm, remember that the key to saving lies in understanding your options and making informed choices. Trust State Farm to be your partner in securing the coverage you need at a price you can afford.

Answers to Common Questions: Car Insurance Quote State Farm

What factors influence car insurance quotes?

Car insurance quotes are influenced by factors such as age, driving history, and location, among others. These variables play a significant role in determining your premium rates.

How can I lower my car insurance premiums with State Farm?

To potentially lower your car insurance premiums with State Farm, consider factors like bundling policies, maintaining a good driving record, and exploring available discounts.

What types of coverage options does State Farm offer for car insurance?

State Farm provides various coverage options, including liability, comprehensive, collision, and uninsured motorist coverage. Each type offers different levels of protection for your vehicle.