Cheap car insurance quote State Farm – Get ready to discover the secrets to saving big on your car insurance while getting top-notch coverage. From understanding State Farm’s offerings to comparing rates, this guide has you covered.

Are you tired of overpaying for car insurance? Look no further – State Farm is here to help you get the best deal possible.

Introduction to State Farm Car Insurance

State Farm is a well-known insurance provider that offers a variety of insurance products, including car insurance. With a strong reputation for reliability and customer service, State Farm has been a go-to choice for many drivers looking for coverage.

Types of Car Insurance Coverage Offered by State Farm

- Liability Coverage: This type of coverage helps pay for the other party’s expenses if you are at fault in an accident.

- Collision Coverage: Covers damage to your own vehicle in the event of a collision with another car or object.

- Comprehensive Coverage: Provides coverage for damage to your car from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Helps cover medical expenses for you and your passengers regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are in an accident with a driver who doesn’t have insurance or enough insurance to cover your expenses.

Importance of Getting a Cheap Car Insurance Quote

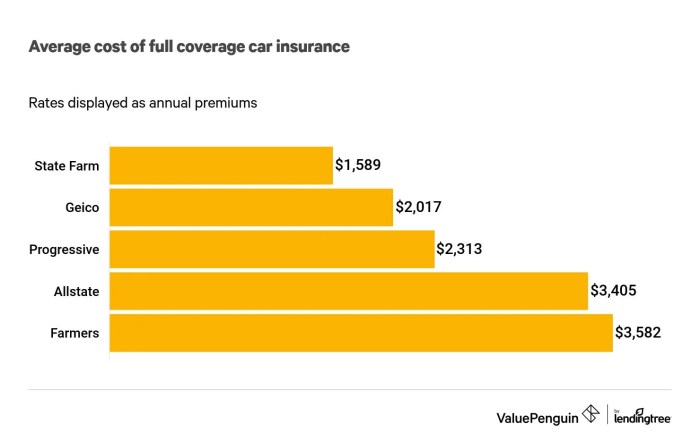

Getting a cheap car insurance quote is essential for ensuring you are getting the best deal on your coverage. By comparing quotes from different insurance providers, you can potentially save a significant amount of money while still maintaining the coverage you need.

Are you looking to compare auto insurance quotes? State Farm is a popular choice for many drivers. Visit Compare auto insurance quote State Farm to see how their rates stack up against the competition. Don’t settle for the first quote you receive, shop around and find the best deal for your needs.

It’s important to remember that the cheapest option isn’t always the best, so be sure to consider the coverage and customer service offered by the insurance provider.

Are you looking to compare auto insurance quotes? Look no further than State Farm! With State Farm, you can easily compare auto insurance quotes online to find the best coverage for your needs. Click here to Compare auto insurance quote State Farm and see how much you could save!

Factors Affecting Car Insurance Rates

When it comes to car insurance rates, several factors come into play that can influence how much you pay for coverage. Understanding these factors can help you make informed decisions when shopping for car insurance.

Driving Record

- Your driving record plays a significant role in determining your car insurance rates. If you have a history of accidents or traffic violations, you may end up paying more for coverage.

- Safe drivers with a clean record are usually rewarded with lower insurance premiums.

Age and Gender

- Younger drivers, especially teenagers, tend to pay higher insurance rates due to their lack of driving experience and higher likelihood of being involved in accidents.

- Gender can also affect insurance rates, with young male drivers typically facing higher premiums compared to female drivers of the same age.

Vehicle Type

- The type of vehicle you drive can impact your insurance rates. Sports cars and luxury vehicles are usually more expensive to insure due to higher repair costs and theft rates.

- Safety features and anti-theft devices in your car can help lower insurance costs.

Location

- Where you live can also affect your car insurance rates. Urban areas with higher traffic congestion and crime rates may result in higher premiums compared to rural areas.

- States with no-fault insurance laws may have different rate structures compared to states with traditional tort systems.

Credit Score

- Insurance companies often use credit scores as a factor in determining rates. A higher credit score may result in lower premiums, as it is seen as an indicator of financial responsibility.

- Improving your credit score can help lower your car insurance rates over time.

State Farm’s Rate Calculation

State Farm calculates insurance quotes based on a combination of these factors, along with other variables specific to your individual circumstances. By understanding how these factors influence rates, you can better assess the quotes provided by State Farm and compare them with other insurance providers.

Tips for Getting Cheap Car Insurance Quotes

When it comes to finding affordable car insurance rates, there are several strategies you can use to help lower your premiums and save money. From bundling policies to maintaining a clean driving record, here are some tips to consider:

Bundling Policies for Discounts

- One effective way to get cheap car insurance quotes is to bundle your auto insurance with other policies, such as homeowners or renters insurance. Insurance companies often offer discounts for customers who have multiple policies with them.

- By bundling your policies, you can enjoy the convenience of having all your insurance needs met by one provider while also saving money on your premiums.

Impact of Driving History on Insurance Premiums

- Your driving history plays a significant role in determining your car insurance rates. Insurance companies look at factors such as accidents, traffic violations, and claims history to assess your risk as a driver.

- Drivers with a clean record and no history of accidents or tickets are likely to qualify for lower insurance premiums compared to those with a history of violations.

- It’s essential to practice safe driving habits and maintain a clean record to help reduce your insurance costs over time.

Online Tools for Comparing Quotes

When it comes to finding the best car insurance quote, online tools can be incredibly helpful. These tools allow you to compare quotes from different insurance companies quickly and easily, helping you find the most affordable option that meets your needs.

Step-by-Step Guide on Using Online Tools, Cheap car insurance quote State Farm

- Start by visiting a reputable car insurance comparison website.

- Enter your zip code and some basic information about yourself and your vehicle.

- Review the quotes provided by various insurance companies, taking note of the coverage options and prices.

- Select the quote that best fits your budget and coverage needs.

- Contact the insurance company directly to finalize your policy.

Advantages of Using Online Platforms to Compare Quotes

- Convenience: You can compare quotes from multiple insurance companies without having to visit each one individually.

- Time-saving: Online tools provide instant quotes, saving you time compared to calling or visiting insurance agents.

- Transparency: You can see all the available options and prices in one place, making it easier to make an informed decision.

- Potential savings: By comparing quotes, you can find the most affordable option that still provides the coverage you need.

Closing Notes

In conclusion, with State Farm’s cheap car insurance quotes, you can drive with peace of mind knowing you have reliable coverage at an affordable price. Don’t wait, get your quote today and start saving!

FAQ: Cheap Car Insurance Quote State Farm

How can I get a cheap car insurance quote from State Farm?

To get a cheap car insurance quote from State Farm, you can reach out to a local agent, visit their website, or call their toll-free number for assistance.

Does State Farm offer discounts for bundling policies?

Yes, State Farm provides discounts when you bundle multiple policies such as car insurance and home insurance together.

What factors can affect my car insurance rates with State Farm?

Factors like your driving history, the type of car you drive, and your location can influence your car insurance rates with State Farm.